Gold has always been seen as a reliable store of value, especially during times of economic uncertainty. Traditionally, investors turned to physical gold in the form of coins, bars, or jewelry. But in recent years, a smarter alternative has emerged—Sovereign Gold Bonds (SGBs). Backed by the government, these bonds allow investors to enjoy the security of gold without the hassle of storage. If you’re considering adding gold to your portfolio, it’s worth exploring the benefits of investing in Sovereign Gold Bonds.

What Are Sovereign Gold Bonds?

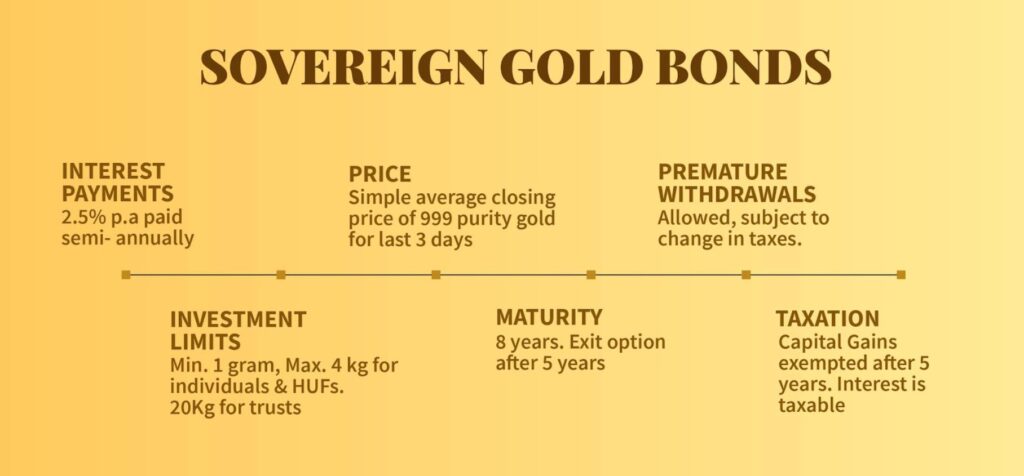

Sovereign Gold Bonds are government-issued securities that represent gold in grams. Instead of buying physical gold, you purchase a bond that is linked to the price of gold. The Reserve Bank of India (RBI) issues these bonds on behalf of the government, making them one of the safest ways to invest in gold.

Each bond unit is equivalent to one gram of gold, and the minimum investment usually starts with just one unit. Investors can buy them through banks, post offices, or designated stock exchanges during the issue period.

Key Benefits of Sovereign Gold Bonds

1. Safety and Reliability

One of the biggest advantages of SGBs is safety. Unlike physical gold, there’s no risk of theft, impurity, or storage issues. Since they are backed by the government, the credit risk is practically zero. For investors who want peace of mind, SGBs provide the perfect combination of security and convenience.

2. Attractive Interest Income

Unlike buying physical gold, SGBs offer an additional return in the form of annual interest, typically around 2.5% per year on the initial investment amount. This interest is credited directly to your bank account every six months. Essentially, you’re earning a fixed income while still enjoying exposure to gold prices.

3. Capital Appreciation Potential

SGBs are linked to the market price of gold. If gold prices rise over time, the value of your bonds also increases. At maturity, you receive the prevailing market price of gold in addition to the interest earned. This makes SGBs a unique investment that offers both fixed income and capital appreciation.

4. Tax Benefits

Sovereign Gold Bonds are also tax-friendly. If you hold them until maturity (usually eight years), the capital gains are exempt from tax. This is a major advantage compared to selling physical gold, where capital gains are taxable. Additionally, the interest earned is taxable, but the overall tax benefits make SGBs more appealing than most other gold investment options.

5. Easy Liquidity and Trading

Although the maturity period is eight years, SGBs come with exit options after the fifth year. They can also be traded on stock exchanges, giving you flexibility if you want to exit earlier. This liquidity makes them far more convenient compared to gold jewelry or coins, which often come with making charges and resale deductions.

6. No Storage or Extra Costs

One hidden cost of owning physical gold is storage and insurance. With SGBs, you don’t need lockers, vaults, or worry about safety. Since they exist in digital or certificate form, there are no additional costs involved. This makes them a more cost-efficient option for long-term investors.

7. Can Be Used as Collateral

Another practical benefit of Sovereign Gold Bonds is that they can be used as collateral for loans. Banks and financial institutions accept them as security, just like physical gold. This means your investment can serve a dual purpose—wealth creation and access to credit in times of need.

Who Should Invest in SGBs?

SGBs are ideal for investors who:

-

Want exposure to gold without physical handling.

-

Prefer safe, government-backed investments.

-

Are planning long-term wealth creation, such as retirement or children’s education.

-

Want to enjoy both fixed interest income and potential appreciation.

-

Seek tax-efficient investment options.

Example of Returns

Suppose you invest in 20 grams of gold through SGBs at ₹6,000 per gram. Your initial investment is ₹120,000. You also earn 2.5% interest annually, which equals ₹3,000 per year. If after eight years gold rises to ₹8,000 per gram, your bonds will be worth ₹160,000.

That’s:

-

₹40,000 capital appreciation

-

₹24,000 total interest over eight years

-

₹64,000 in total gains (excluding taxes on interest)

This example highlights the wealth-building potential of SGBs over the long term.

Final Thoughts

Sovereign Gold Bonds combine the best of two worlds: the stability of gold and the reliability of government securities. They offer safety, interest income, tax benefits, and capital appreciation without the risks and costs associated with physical gold.

For anyone looking to diversify their portfolio with gold while focusing on long-term wealth creation, SGBs are a smart and efficient choice. Instead of worrying about purity or storage, you can sit back and let your investment grow steadily.

In a world where financial markets fluctuate and uncertainty is constant, Sovereign Gold Bonds provide investors with what gold has always promised—security, stability, and lasting value.